Landmark Case for Swiss Franc Borrowers

In a recent decision, Athens Court vindicates borrowers in relation to lending in Swiss Francs, said a spokeswoman for LLPO Law Firm - Makris and Ioannides.

Click here to follow the company on Linkedin.

“The Athens Court of First Instance accepted the request of our clients and issued a Court Order against the Bank, to reduce the amount of the installments paid by the borrowers to the Bank,” said the law firm.

The court ordered the borrowers to repay the installments at the EURCHF exchange rate that applied when the loan was started, rather than the current rate. The EURCHF rate was considered to be stable from 2004-2015, but when the Swiss National Bank depegged the rate from 1.20 CHF per EUR, things changed rapidly because the euro devalued considerably against the CHF. Someone earning a salary in Euros suddenly found their installments rising by up to 15% as the Swiss Franc soared.

This also applies to a large number of Cypriot borrowers who contracted in foreign currency loans, resulting with the balance of their loans to be much higher and are now requested to pay those sums in unimaginable high installments, said the law firm.

The lawyers have also raised similar cases in Cyprus and with the appropriate and proper handling, could affect the cases in Cyprus.

“Although the decision is based on Greek law, the issues raised have Europe-wide application and confirm a Europe-wide trend compared to differences between borrowers and Banks, in the highly debated issue of lending in foreign currency,” said the spokeswoman.

For more information on this subject, contact Mr. Theodoros Makris - Partner LLPO (Greece), Mr. Michalis Ioannides - Partner LLPO (Cyprus) and Mrs. Maria Angelides - Head of Banking Affairs Department LLPO (Cyprus).

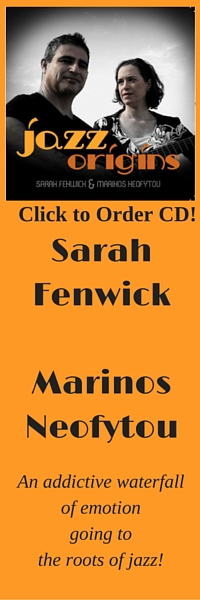

About Sarah Fenwick

Editor, journalist, jazz singer and digital marketing consultant.

Bookmark worthy

- Non Gamstop Casino

- Casino Not On Gamstop

- Non Gamstop Casinos

- Casino Italiani Non Aams

- Slot Sites Not On Gamstop

- Best Non Gamstop Casinos UK 2025

- Crypto Casino

- Online Casinos UK

- Betting Sites Not On Gamstop UK

- UK Casino Not On Gamstop

- Best Non Gamstop Casinos

- Sites Not On Gamstop

- Online Betting Sites Not On Gamstop

- Non Gamstop Casino

- UK Casinos Not On Gamstop

- Non Gamstop Casino

- Casino Sites Not On Gamstop

- Casino Non Aams

- Casinos Sin Licencia España

- Casino Sites UK

- Slots Not On Gamstop

- Best Slot Sites For Winning UK

- Casino En Ligne

- Slots Not On Gamstop

- Non Gamstop Casino Sites UK

- Casino Non Aams

- Non Gamstop Casinos

- Meilleur Casino En Ligne France

- Meilleurs Sites De Paris Sportifs Belgique

- Nouveau Casino En Ligne Belgie

- Nouveau Casino En Ligne Francais

- Paris Sportif Ufc France

- Casino En Ligne Retrait Immediat

- Migliori Casino Online

- Site Casino En Ligne

- Nouveau Casino En Ligne Francais

- Casino En Ligne Francais

- Casino En Ligne

- Best Online Casino Sites In Malaysia

- Avis Tortuga Casino

Leave a reply

You must be logged in to post a comment.